Rising SEAs

I was in Vietnam two weeks ago. My first visit to the country in fifteen years (which is a long time considering I’m a two-hour flight away). We don’t invest in Vietnam yet, but when a broker invited us to meet several companies, I hopped on a plane to Ho Chi Minh.

It was a short three-day trip, but even in that time, I noticed significant differences since the last time I was there.

Rule of law: The first thing that catches your eye when you leave HCM airport is the hordes of scooters. At first it looks like madness, but then you start to notice that all riders (driver or otherwise) are wearing helmets. It doesn’t sound like much but a society that is rules-based starts with the basics. Stop at red lights. Don’t do drugs. Pay your taxes. Don’t be corrupt. On the last one, Vietnam has gone to extreme measures to tackle corruption. It recently sentenced a real estate mogul to death for fraud, has removed dozens of central committee members, and forced the resignation of the former President! One of the first things Lee Kuan Yew did when Singapore gained independence was to instill a zero-tolerance policy toward corruption, a move that steeled foreign investors' impressions of the country. It may not be obvious, but a hard line against corruption really opens a market to wary investors. India, over the past few years, has cracked down on corrupt bankers and thrown many in jail. PSU (gov-owned) banks which were, for a while, shunned by investors have had an epic run since. Over the last ~3 years, banks like SBI and PNB have seen their stocks rise 100% and 230% respectively, far outstripping private banks like HDFC Bank and Kotak which are flat over the same period. Ironically, ICICI Bank (private) has also had a good run, after its CEO was purged post a money laundering scandal. I’m not saying the anti-corruption movement is the sole driver of stock performance (there is a reversion to the mean w.r.t to valuation, improving assets & growth, etc.) but it certainly is a factor.

English speaking: I was pleasantly surprised how well-versed local analysts and executives were in the English language. Granted there is a sample bias here as the local broker would only take us to companies where executives spoke English, but I was still quite pleased by the filings and investor meetings in English. Only one meeting I attended required an interpreter. One of the criticisms of the Japanese markets for years was that most filings were in Japanese. The exchange has tried to fix that over the last few years, and along with several other initiatives has driven significant foreign investment interest.

Reverse brain-drain: Some of the executives I met were American. Vietnamese American but American none the less. Born in America, spoke with American accents, and still maintained their citizenships. Masan Group, one of Vietnam’s largest conglomerates is day-to-day run by ex-bankers who grew up in the West but returned to Vietnam for the opportunity. Masan’s CEO and Deputy CEO are from Boston. They are also only in their early 40s, implying that they are yet to make their fortunes, and believe Vietnam the best place to do it.

Interesting business models: Typically, for food retail to work you have two types of businesses. One, large format stores that sell fresh food in bulk (think cash & carry, supermarkets etc.) or convenience stores (like 7-11) that sell non-perishable items on the go. But I noticed several small-format stores selling fresh produce. Companies like Winmart (Masan Group) and Bach Hoa Xanh (Mobile World) are taking advantage of a young and mobile (I mean this literally, they are all on scooters) consumer who needs to buy just a few items for the night’s dinner. It’s a hard model to crack. Fresh produce can have good margins, but the slippage kills much of the profit, so you need volume to make it up. Thus, many of these subsidiaries are just about breaking-even. But I appreciate the innovation here. I also saw one retail concept that only sells milk and yogurt. That’s one way to release ecommerce’s throttle on your business!

Investment Opportunities: I got a strong sense that the foreign investor community has reached consensus on what is worth investing in and what isn’t in Vietnam. Although this is not without reason. There are some very well-run companies in the country. FPT (basically the Vietnamese Infosys) has consistently grown top and bottom lines. The banks have done very well, although interestingly this was truer for the government-linked ones. It turns out the Vietnamese don’t trust private banks as much, and thus, their CASA ratios are extremely low. FMCG is hot. Pharma has some interesting tailwinds as the government tries to decrease their reliance on imports. I even met a plastic pipes company with 20%+ profit margins, nearly 30% returns on equity, and almost no debt. While this was just a short crash-course into the country, I found enough interesting companies to dig further.

Aside from the observations above, I also noticed Ho Chi Minh was affordable, easy to get around, filled with several public parks/spaces and has a developed waterfront. If I were at a younger stage of life, it could have been a fascinating city to spend a few years in.

Given all of this, throughout my trip, one thought kept creeping into my head. Southeast Asia is catching up. 20-30 years ago, Singapore was the crown jewel of the region, which drew much of the foreign investment and talent. However, my trip to Vietnam made me question if this was still sacrosanct (and this is coming from a proud Singaporean). There is a rule of law, and changing regulation (abolishment of pre-funding requirement) is making it easier for foreigners to invest. Vietnam is home to solid entrepreneurs and executives, and legit companies to invest in. The country is also investing heavily in its ports, to compete with Singapore. Apps like Grab and Shopee provide many of the convenience you experience on our island nation, and affordability in countries such as Vietnam make it a strong competitor for talent. That said, Singapore has a stability and consistency that cannot be beat by our neighbours (yet). Vietnam, for example, still shows elements of its bureaucracy. Leaving the country takes far more time than entering it! Further, my conversations with locals highlighted some frustrations with processes and despite it being a one-party rule/landscape, succession uncertainty did affect markets for a while.

Competition catching-up is not unusual. You see it all the time in business, sports, academics. To stave off that competition, one needs to constantly innovate, reinvent, and push past the ceiling that previously existed. But improving competition in this case, I think, is not a zero-sum game. Your neighbour doing well can be a good thing. I’m sure the US benefited from a solid Canada and a rising Mexico. A secure and prosperous Pakistan would be in India’s best interest. A rising Southeast Asia should benefit all parties involved. For investors this matters in two ways – first it opens the ‘beta’ factor. Investors looking for exposure generally invest in the region through broad-based instruments (thus a rising tide lifts all boats), and second it benefits companies that have exposure across the region. Which leads me to:

Sea’s earnings:

Long-term readers know I can’t resist commenting on this company. Usually, it’s in defense of the thesis, but this time the company did the talking by posting solid numbers across the board.

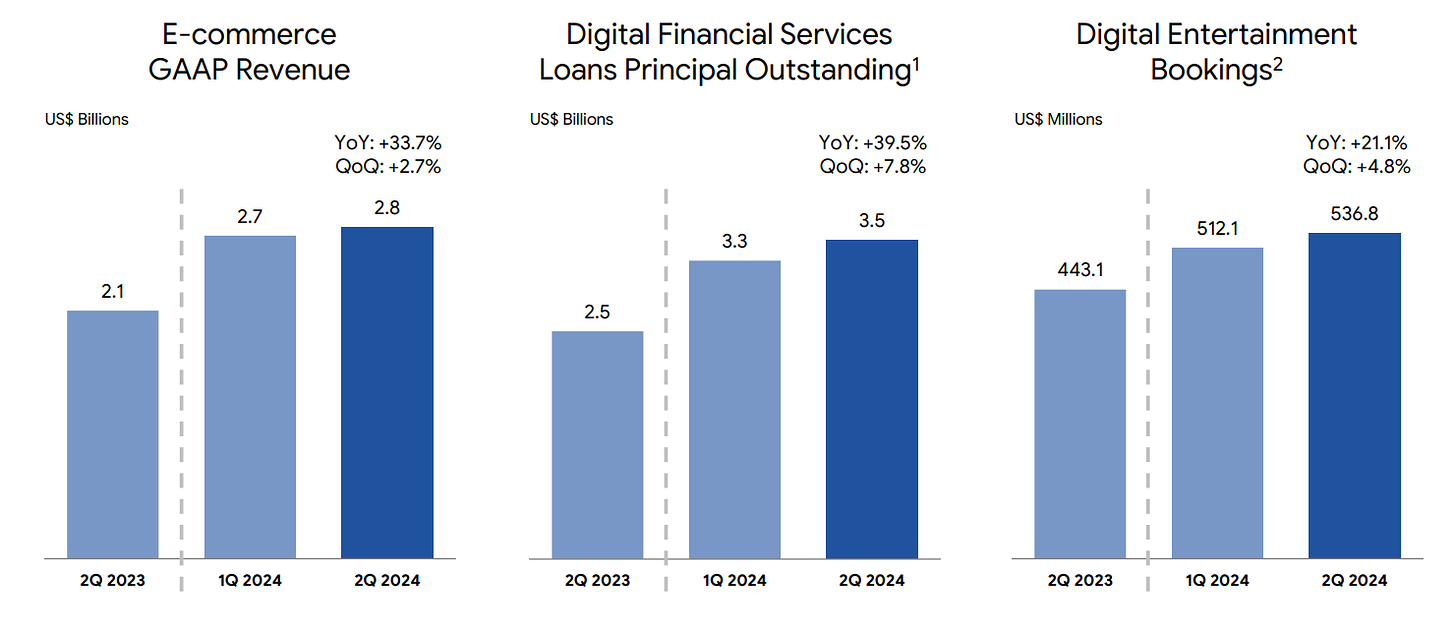

The stock has responded in kind with a strong ~115% move this year. It’s good to see each of the company’s three businesses firing on all-cylinders. There’s a lot of details we can go into here, but to stick to the topic, reflecting on its earnings two truths revealed themselves.

It’s hard to beat a committed (and competent) player. Sea flew a bit too close to the sun 2021 when it expanded Shopee to markets in India, Europe and LATAM. A 85% stock wipeout and a stricter funding environment forced the company to pull-back and refocus on its core. I might be premature in saying so, but I think this might have been one of the best things to happen to the company (and for long-term investors). Imagine trying to take on aggressive TikTok and Temu while fighting battles in multiple regions. The fact that TikTok shop launched in Southeast Asia during a time when Shopee had refocused on the region was lucky timing for Sea. Given their considerable lead, in the market, all they had to do was put their head down and execute. Work on the customer experience, capture sellers during TikTok’s temporary withdrawal from Indonesia, and expand their internal logistics network. Over the last several quarters, it did seem that investors were more worried about competition than management was. But it’s quite clear now that competition is eating itself while Shopee gains market share. On my recent trip to Vietnam, I asked consumer analysts about the state of ecommerce competition in the country. They all said that while TikTok Shop was gaining ground, it was at the expense of Lazada and others. Shopee, it seemed, remained firmly ahead. Recent data confirms this observation:

One of my key concerns over the past two years on Shopee (I’m always paranoid about our holdings) is how much it could grow GMV. Let’s take Indonesia for example, the largest, and most important market in the region. It grows its GDP ~5% a year. Domestic consumption accounts for nearly 60% of GDP, so by inference, consumption cannot be growing all that much faster than GDP. Thus, my fear was that at best, Shopee would grow GMV in the country by high single-digits. The counterpoint here is obviously that ecommerce penetration will increase. But my hesitation was that we’re just coming off covid, a time where literally everyone was locked indoors. Despite this, ecommerce penetration in the county at best reached ~20-25%. So, it could be fair to assume that when society opened up, ecommerce penetration would stall. But it hasn’t. Shopee’s GMV in Indonesia seems to be growing close to 30% YoY, which implies ecommerce penetration is far outpacing GDP and consumption growth. Ecommerce penetration does not increase in a vacuum, it does so because providers invest in marketing, logistics, and of course, the platform. The only reason they do so is because they see opportunity, and that they agree that the SEAs are rising.

Thanks for reading, and happy investing.

Chart of the Week

Drinking isn’t cool: US males are not binge drinking as much as they used to. It seems like cannabis or non-alcoholic alternatives are becoming a more popular choice amongst revelers.

Links of the Week

A thought-provoking paper on why the S&P 500 equal-weighted index might start outperforming the market-weighted index. It states “major turning points have historically coincided after extremes in mega-cap performance and in the performance of momentum stocks.”

A solid deck on SAAS investing and what’s gone wrong.

‘The Last 72 Hours of Archegos’ was a fascinating read (behind paywall). Jefferies handling of the situation was epic.

Howard Marks discusses the reasons for the recent market volatility.

A kind request - if you enjoyed this newsletter, I would be most grateful if you could give it a ‘like’ or share it. Thank you!

My first write-up here was on FPT, so I agree with you there that it's well-run, and there's one big opportunity in pharma that has me excited now (aside from DHG, which I'm always eager to buy on large sell-offs).