When going through hell...

This week we discuss the path forward, Singapore's gambling addiction, and reflect on Bernanke's view on inflation.

Dear Clients and Friends of Farrer Wealth Advisors, we are pleased to bring you the Farrer Wealth newsletter, which includes our latest blog posts, fun facts, and general articles we find interesting. Happy reading and happy investing!

Latest Blog Post

When going through hell….

“If You're Going Through Hell, Keep Going” - Winston Churchill

There will be a day when I start these blog posts without a quote – but it is not this day! This quote from Churchill has been one I keep in mind for all the trials and tribulations that life throws at us. Though this quote was delivered for a far more extreme situation (the UK was badly losing against the Germans in WW2) than most of us will face, it is still quite apt for this bear market we are going through

Inflation rising unabated, interest rates going up, a war in Europe, and a potential recession coming, the macro environment looks very bad. We’ve seen panic selling the markets, and the tweet below regarding the June 13th US trading session is quite the summary of the extent of the market stress.

(A downside day is where declining volumes outstrip advancing volume)

The S&P 500 has entered bear territory to join the Nasdaq and the MSCI World Index. Emerging markets (as indicated by the FTSE Emerging Market index) have been in one since March this year. There are few investors or market commentators who remain bullish, and the professional managers I speak to are somewhat resigned to the MTM losses in their portfolio. The question we’ve been thinking through is given all of this – what we do now. There are a few possibilities – and while there are tweaks and short-term remedies that work to an extent, the only thing I can think about doing is, well, to keep going. But before we get to the conclusion, let’s look at a few options investors can consider:

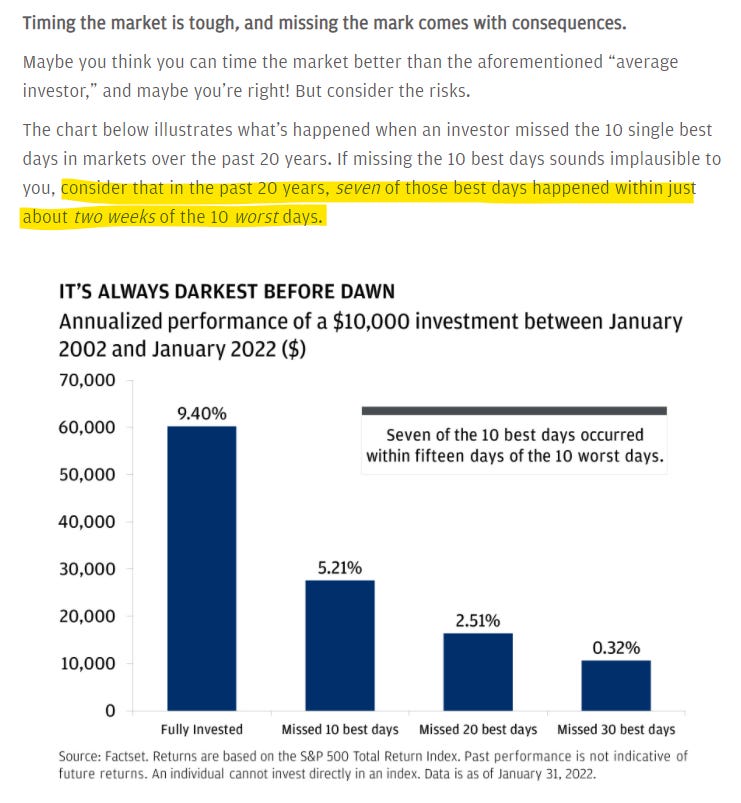

Call it a day and cash out: This is certainly tempting for those who can’t take the pain anymore. There is also nothing to say markets can’t get worse. I sometimes get asked by clients and friends why I don’t do this. Why not just wait it out? I’ve been working long enough to have seen 3 extreme drawdowns: 2008, 2020, and now 2022 (which funnily is the least extreme on the index level, but quite comparable on an individual stock level). In each of the previous two drawdowns, there was no “all-clear” signal for when to get back into the market. By the time those sitting on the side-lines realized that it was a good time to invest, most of the gains to be had, had been had. My friend Shree of SVN Capital, shared this post (see below) a while back. The post, by JPM, describes how seven of the best 10 days in markets occur within fifteen days of the 10 worst days. Thus, timing the bottom or anything of the sort is a dangerous game. If you play the game poorly you miss the upside. Investors typically try to protect downside, which while prudent and natural (we feel losses twice as hard as we feel gains), it can make you forget that gains compound and losses are limited.

Diversify: I often have conversations about diversification with clients. Diversification gets a bad rap from gurus like Warren Buffet who claim diversification is an admission that you don’t know what you’re doing. I find this difficult to digest as investing is based on probabilities and not diversifying means you’re 100% sure of outcomes, and that comes off as a bit arrogant (also, most of us are not Warren Buffett). Even in our Managed Solution, while we run a concentrated portfolio in terms of number of positions, we hold positions in tech, consumer discretionary, consumer non-discretionary, BPO services, and financials. The problem with the diversification conversation is that investors tend to seek it when markets are already in a bad shape. They look for non-correlated assets at a time when their portfolio is bleeding, and they want to stem the tide. Over the past month I’ve had several discussions with clients and other market participants wanting to invest in commodities, energy, consumer non-discretionary etc. It’s understandable, as we’ve seen over this past calendar year, investors who had large exposure to energy and commodities really outperform, and I applaud their forward thinking. However, several of these investors had to endure years of underperformance from those investments during which they were a drag on their portfolios. Thus, during market drawdowns, investors late to the game will seek to diversify to provide short-term comfort but then get annoyed when the market rallies and that diversification is a drag on their returns. Now none of this is meant to say that energy et all won’t do well going forward, this is more of an example to explain the issue with diversifying late in the game. Diversifying can be beneficial, but it has its drawbacks and investors looking to diversify now should really have a strong sense of what shape their emotions might take when the market turns.

Hedging/Shorting: I have a love/hate relationship with hedging. While we do employ hedges in our portfolio, and it has had a positive impact over the last 9 months, I do find it hard to implement consistently. Timing, time value erosion, the high cost of volatility makes hedging in this environment tricky. While we never short, we have seen long/short funds do quite well this year mostly due to the gains on the short side of their book. However, in this recent interview, Stanley Druckenmiller, one of the world’s best-known traders, stated that in all his bear market experience over a ~50 year career that doesn’t short this late into the game because according to him “if you get aggressive on the short side in a bear market, you get your head ripped off in rallies.” Hedging I find is effective, but it more takes the edge off and works when there are steep drops in the market but does far less well when there is a sustained decline peppered with sharp rallies. Shorting, as we’ve said several times, is not for the faint of heart, and not something I would recommend someone do who already doesn’t have a robust strategy in that area.

Structured Products: This option is probably more unique to my part of the world. But each week I see private banks pushing structured products on to clients. These offerings are the finest products in the market for transferring wealth from clients to banks. One of the key culprits in this environment are equity linked products (either equity linked notes or accumulators). These are typically short-dated products with limited upside and massive downside. Essentially, they give you all the risk of owning equity with almost none of the benefits. However, because they offer high short-term yield, customers add them to their portfolio to make a quick buck. This is somewhat understandable as customers do what they can to offset their losses in a bear market. But here’s the rub. The risk of these notes is driven by the feature that you must buy large amounts of the underlying stock if the price falls below a certain level. This risk is justified away by buyers of the notes thinking that “Oh, I would love to own stock X at 25% down.” But as the last six months have shown us, it’s not just that the price of a stock has fallen and everything else has stayed the same. The macro environment has significantly deteriorated and the outlook on most companies is foggy. Also, it’s unlikely to be just a 25% drop; in this market – more like 40-60%. If it’s not clear, I despise these products, and don’t think they deserve a position in your portfolio in this environment (or any environment). Just to put this in context, I was speaking to a potential client who told me he was going to wait a while to invest and when I asked why (not that I don’t understand the current fear) he mentioned he had just been burned by several equity-linked notes and just didn’t have the stomach for further equity investments.

Raise cash: If you can raise cash, I think this is certainly an opportune time to do so. However, it shouldn’t necessarily be via your current holdings, unless your thesis is impaired. As we’ve explained in the first point, markets can turn on a dime. If, for example, you have an investment property you’ve been looking to exit – this might be the moment, as interest rates rise and recession hits, housing prices will also be impacted. So, a rebalance of asset allocations might be prudent.

Now certainly hindsight is 20/20 and if you were to panic during this drawdown the best time to have done that was late last year. But now that you’re in hell, you just must go through it. Raise cash where you can, hedge when it’s cheap to do so, sell where you no longer have conviction, buy what you see great value in (bear markets expose several opportunities), but mostly your best course of action, in my humble opinion, is to hold on. Every bear market has so far been followed by a bull market, you just must survive and be patient until ‘el toro’ rides again.

We hope you’re taking some time off for the summer and enjoying the weather rather than staring at tickers on your screen! Thanks for reading and happy investing.

Farrer Fun Fact

Singapore’s gambling losses: The above chart shows Singapore has the second worse gambling addiction in the world. Granted this seems to be for just countries which have some sort of legal gambling, but it was shocking nonetheless. The data was taken from an excellent article about Australia’s (#1 on the list) gambling addiction. Read that article by our friend Kalani here.

Articles and Videos of the Week

Ben Bernanke (the former Fed Chair) wrote an opinion piece about how inflation is not going back to the 1970’s levels.

Incase you didn’t have time to watch the whole Stanley Druckenmiller interview that’s going around, our friends at Long River wrote an excellent summary.

We really enjoyed this post about why a recession is not an answer to current inflation problems. It questions the “recession is necessary” narrative.

This thread was a nuanced discussion of how volatility is treated in public vs private markets - and asks a question if private investments should trade at a discount rather than a premium.

This image illustrating path dependence was a great way to illustrate the risk of leverage

An intriguing and detailed post on Grab by Value Punks (not investment advice, no position).