An Update and a Rant

This week we give a portfolio update, discuss a misuse of math, and review an excellent investment checklist.

Dear Clients and Friends of Farrer Wealth Advisors, we are pleased to bring you the Farrer Wealth newsletter, which includes our latest blog posts, fun facts, and general articles we find interesting. Happy reading and happy investing!

Disclaimer - This newsletter is for informational purposes only. None of the below should be considered investment advice nor solicitation for investment. Please see full disclosures at the end of this newsletter.

Latest Blog Post

Portfolio Update + Rant

Dear Readers – sorry I haven’t posted in a while. Work and both personal/business travel got in the way.

To make up for it, today’s newsletter contains a two part-post. The first part is an update on our portfolio, the second is a rant on how IRR is not CAGR and how it gets universally mixed up by even seasoned investors. We have a spectrum of readers but if you even spend even a modicum of time thinking of investing in PE/VC or reading fund letters – I promise you the section is worth your while.

Part 1: Portfolio Update (for the Farrer Wealth Managed Solution)

We released out Q1CY23 letter to our investors earlier this week, and in it we gave updates on some of our larger positions. We post them here for your reading. As usual, none of the below is investment advice.

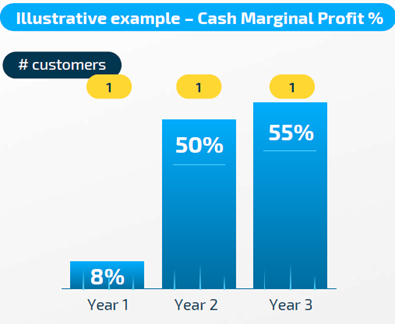

eDreams Odigeo: As some of you may recall, eDreams is the largest OTA (online travel agency) in Europe when measuring flight revenue. To escape the “Google Tax” that most OTAs face, eDreams launched an ambitious subscription program called “Prime” a few years ago. That program, at least in terms of subscribers, has been a raging success with over 4.2MM members in February of this year (up from just 300K in the Q12020). Despite this growth, eDreams stock had a tough 2022 due to Russia’s war with Ukraine, omicron, inflation pinching on consumer’s pockets, and fears of an upcoming recession. It also didn’t help that eDreams, while showing solid top-line growth (TTM revenue has surpassed pre-covid numbers), was still struggling to show operating profit, which in this environment is paramount for investors. Investors’ fear is that the Prime model is unprofitable and gimmicky given no other OTA has been able to replicate it. The theory that management has proposed is that in the initial years, profitability will be lower as marketing costs (to attract subscribers) are higher, but in the second and third year, the acquired subscriber becomes highly profitable (see chart).

Investors were waiting to see this theory proven by financial results and were not willing to take management’s word. The patient money was relieved this past quarter when the company posted a 17% cash EBITDA margin and near break-even operating profit. Now granted there is more to prove before the company hits its FY2025 guidance of 22% in cash EBITDA, but in 2023, the market seems to be rewarding investors as management proves out the model. Despite the rally this year, the company’s stock still trades at less than 6x 2025 cash EBITDA.

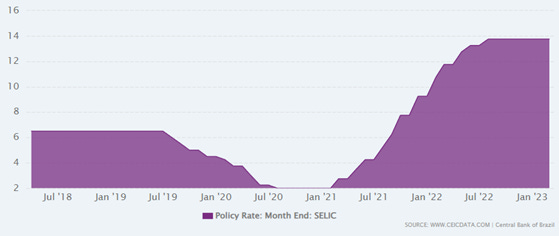

Sendas Distribuidora (Assaí): As a quick reminder, Assaí is the largest standalone cash & carry business in Brazil. We did a mini-writeup on the company that you can read here. Assaí had a phenomenal 2022 with revenues up 30% and 51 stores added. The stock was up over 50% in 2022. The company continues to expand, gain market share, and maintain healthy gross and EBITDA margins (17.5% and 7.3% respectively). The problem facing the company now, despite what we think will be a solid year for them in 2023, is their debt load. Assaí has been in an expansion mode that will continue through 2024. To support this, the company has about BR$6.5bn in net debt (2.3x EBITDA) which considering Brazil’s high interest rate (13.75%), puts a drag on the net income of the business. If these rates were to rise, which is not expected but not impossible, the company may have to cut back on its investments in 2024 and the company may not meet its target of 300 stores and BR$100 billion in gross revenue for that year. While we don’t think this is a major risk, it is one to be watched. The stock has also recently come under pressure with the Casino Group (the erstwhile controlling shareholder) selling down most of their shares in Assaí to deal with their own debt problems. This, combined with an untrue rumour that the company was going to raise an equity round, led to a selloff in the stock. We view Casino’s selling as a positive as we have never liked the group’s involvement in Assaí. Their now minor shareholding allows the company to restructure the board and stack it with 7 out of 9 independent members (with the 8th member being the well-liked CEO of Assaí, Belmiro Gomes). Overall, we think Assaí is executing well, and while interest rate headwinds persist, we think there are multiple solutions available to the company to deal with this. Further, the Brazilian Central Bank is facing significant pressure from the current government to start cutting rates this year. Given how high rates have become (see chart). With inflation coming under control, any cut will be a strong positive for risk assets in Brazil.

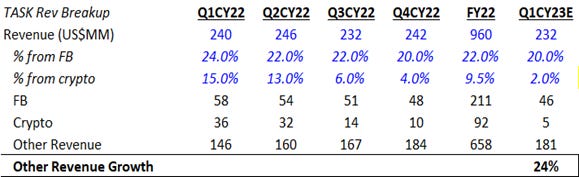

TaskUs: TaskUs (“TASK”) is a global BPO servicing predominantly tech/digital first companies. TASK’s focus on high-value work and a fast-growing client base has given it an average revenue growth of nearly 40% per year over the previous four years. This is significantly higher than the industry’s average single digit growth. The company also maintains healthy EBITDA margins of 15%. The problem TaskUs faces this year is it is lapping difficult comparables from 2021. Its largest client, Meta, while increasing the volume of business that they are doing with TASK has moved that business offshore, which results in lower revenue per seat. Further, going into 2022 TASK had significant (~15%) of revenue coming from crypto trading clients like Coinbase, who have seen reductions in their respective businesses. Because of these two slowdowns, the company has guided to less than 1% overall revenue growth in 2023 with negative growth in the first quarter. The growth rate is like to improve throughout the year, with the company expecting double digit growth toward Q4. While the lack of growth in 2023 is frustrating, we can see that if we strip out the Meta and Crypto revenues, that the rest of the business is still growing at 24% yoy (see table below).

Thus, we agree that once TASK laps the tough 2022 comparable, the company will be exiting 2023 at that strong double-digit growth rate suggested by management. Given that the stock is trading at a less than 10x P/E ratio as of this writing, the odds appear to be in our favour from here on out. There is an existential threat facing the company (and all BPOs) due to AI. The argument here is AI will displace BPO companies by more efficiently/cheaply dealing with customer inquiries. While this is a risk, I have skepticism for this argument. For one, most BPO-related activities are low-value and already handled by AI/Chat bots, much of which is operated by companies like TASK. Second, one of TASK’s key business lines is AI services, and the company does significant work for OpenAI, the company that operates ChatGPT (the AI tool that is all the rage these days). So, can AI be a threat to TASK? In the very long-term, certainly, but for the medium-term I do believe that the “AI” threat is just used as a cudgel by bears.

Sea Limited: What a difference a quarter makes. For most of 2022, Sea’s stock fell like a rock as investors fled after unprofitable companies fell deeply out of fashion. I cannot blame these investors, as we also significantly cut our position in the company over the year. The company, to its credit, internalized the market message and started to heavily cut costs. From exiting all non-SEA markets (except Brazil) to stripping c-suite pay, the company had one goal in mind – get profitable fast. Now, I have been quite critical of Sea’s management in the past, especially when it comes to investor communication and a somewhat arrogant strategy, but I have always believed that when they get focused on a goal, they execute with vigour. Thus, as we ended the year, we started to hear from multiple sources that the company was getting closer to its profitability goals (and the sell-side estimates backed this up). Based on this data, we started to add back to the position. However, it was a shock to all when during the Q4 earnings call the company released profitable earnings several quarters ahead of schedule. The company flipped from a near US$569MM loss in Q3 to a US$423MM profit in Q4. This was a rapid swing, and I must hand it to management for pulling off a minor miracle. Now, the question the market is asking is with profitability in hand, will growth be structurally hindered. It’s a good question (although it does seem that the market switches from one bear case to the next), and the answer will be determined by three drivers. 1) Can the TAM (total addressable market) for ecommerce in Southeast Asia (and Brazil) continue to expand 2) Can Sea continue to rapidly grow the Digital Financial Services (DFS) business without taking too much credit risk and 3) Can Garena supplement the lost income from Free Fire via a release of successful games. I believe that the answer to the first and second question is yes, but investors must be a bit tempered in their expectations. On the first question data put together by Temasek and Bain show double-digit TAM growth well into 2025. Also, considering all competitors need to reduce their cash burn as well, Shopee should maintain market share. On DFS, Sea is certainly tightening up its standards, and took this quarter as an opportunity to tighten its risk metrics by shortening the loan write-off period, which is a positive sign. There is a risk here however of Indonesia further regulating subprime lending, so growth needs to be watched. The question that remains in my mind (and most investors) is if Garena can find another Free Fire (unlikely) or at least produce several smaller hits that make up for the slowdown in Free Fire (more likely). Success in gaming can be a bit random, but we need to see more activity from Garena before we can gain any sort of confidence here. Overall, though, I feel that my faith in management has been restored, and welcome back Sea as one of our top ten positions.

Evolution: Considering the strong performance of Evolution’s stock this quarter, one would think there was a major update. However, there isn’t much new to report on the company. Q4 earnings were strong with revenues, EBITDA, and EPS growing above 30% showing both solid growth and cost control. The company continues to expand rapidly in North America, Asia, and other markets (such as LATAM). While the company continued to impress, Asia is now its biggest market, which does cause some concern, given that most of that market is grey. Thus, we would like to see continued growth in North America and RoW to offset the Asia risk.

The above is just some sample commentary on our portfolio - should you wish to discuss further, please do reach out.

Part 2: IRR ≠ CAGR

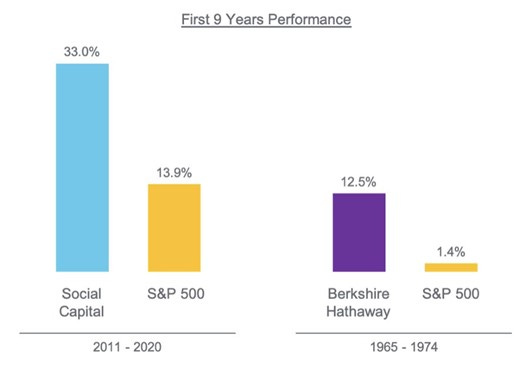

This topic got brought on my radar again when famed/ridiculed (take your pick) Investor Chamath Palihapitiya released the annual letter for his fund Social Capital. Granted he didn’t do it in the most recent letter, but in his 2020 one, he compared his returns, to Berkshire’s Hathaway and how much superior they were.

The marketplace did not let him forget this hubris (he has had a terrible performance since) and analysts on Twitter re-circulated this table for their own perverse pleasure. What drives me crazy is not the hubris, but the bad math. Social Capital is making a cardinal mistake of equating IRR (their returns) with CAGR (S&P 500/Berkshire returns). One might look at this table and say – wow 33% is much better than 12.5% but I would say, very loudly, and annoyedly “THAT’S NOT THE SAME THING!!” Even if that 33% was the net of fees number (…it is not) it would still not be the same thing.

I’ll repeat this as many times as required. IRR is not CAGR. IRR, an internal rate of return, is highly dependent on timing. The key part of CAGR, compounded annual growth rate, is “compounded” bit which assumes that your money will grow, on average, by a certain rate annually. IRR on the other hand is a discount rate that at which the net present value all your cashflows is zero.

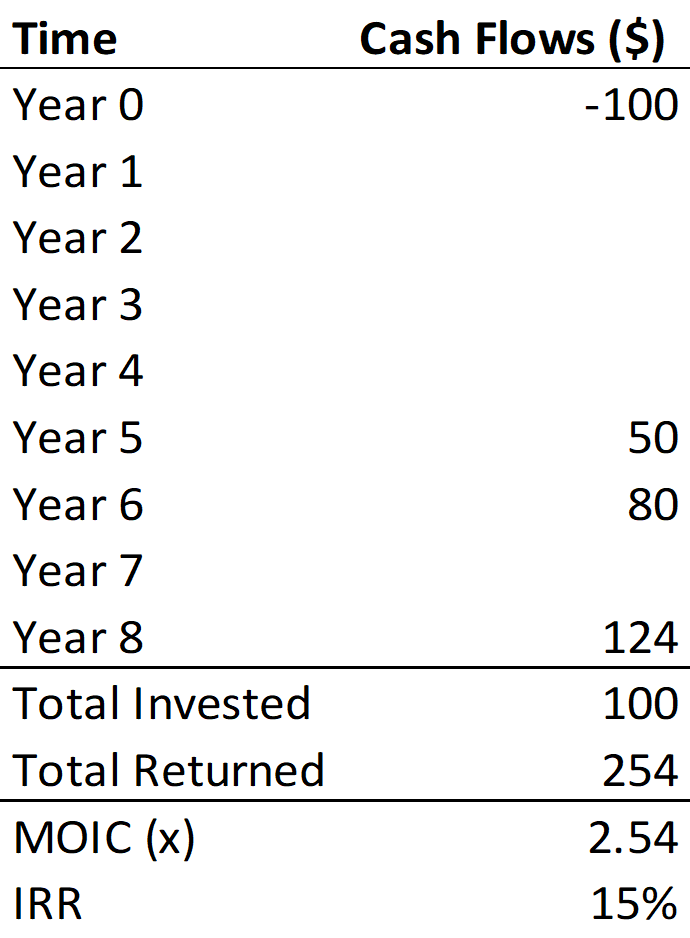

I know that was a bunch of word salad, so let me show what I mean. Let’s say you’re evaluating an investment in a venture capital fund and their previous fund (which assume lasted 8 years) had an IRR of 15%. You think ok that’s great. If I give them $100 I’ll get back roughly $300 in 8 years (306 = 100*(1.15)8). But then, as you leaf through the marketing material, you notice the MOIC (multiple on invested capital) is only 2.54x.

That’s because IRR is highly dependent on the timing of cash-flows. And as PE/VC funds go, they call capital and distribute returns at various times. So, to understand what that IRR means you must understand the cash flows of the fund.

As you can see from the above example because of the timing of the cash flows, the IRR looks high, but the actual cash you get back will be lower than you expect.

So, in the Social Capital example, not only is Mr. Palihapitiya showing significant arrogance, but he is also not even doing it correctly. In the first part of the chart he compares his fund’s returns (33%) versus the S&P 500 (13.95%). The problem is, if you invested in the S&P 500 during that time your money would have compounded at 13.95%, however in his fund your money would certainly not have compounded at 33% (he didn’t give the MOIC number so we can’t make a proper comparison).

Just two more quick examples to drive this whole IRR ≠ CAGR point home.

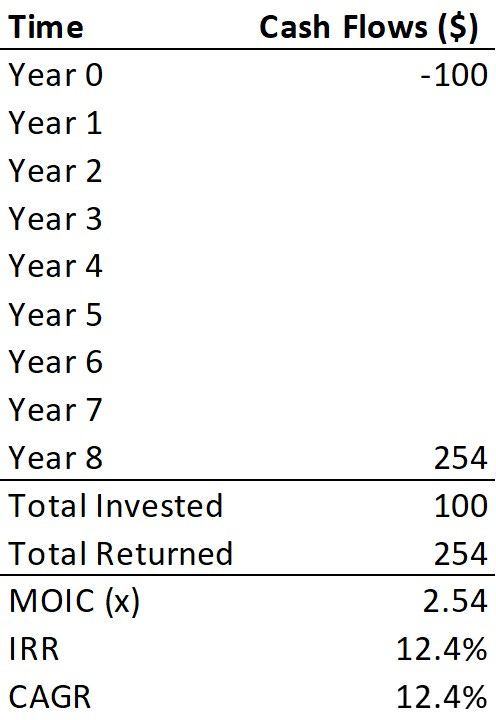

Another question is, can CAGR and IRR ever be the same? Yes certainly, but only if the timing is the same. See the example below where CAGR and IRR is the same.

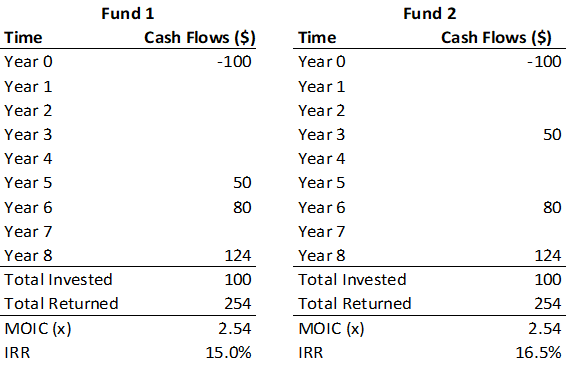

Astute readers may notice that due to their reliance on timing, IRR can be highly manipulated. This is spot on. PE/VC funds are experts at IRR manipulation, and to show you how this is done, we will go through a final example.

The above two scenarios are almost identical. The only difference is the timing of the $50 return of capital. In the first fund it happens in Year 5, and the second it happens earlier, Year 3. Just this slight timing difference leads to a bump in IRR for the second fund. Thus, be bit wary of private funds that show you distributions early, it could be a case of IRR massaging.

Now, none of this is to say that IRR or CAGR is a better tool, not at all, they both have their own place and use. However, its important to know the difference and how each calculation can be manipulated. Unfortunately, as much as the market loves to dump on Palihapitiya, his mistake is a common one.

Thanks for reading, and happy investing - Pratyush

Farrer Fun Fact

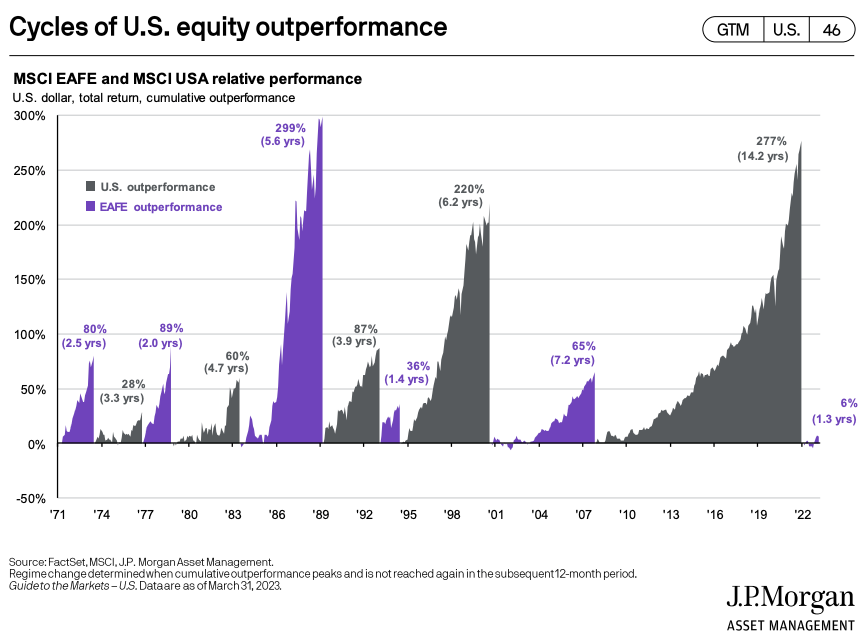

A new cycle? This chart from JPM has been circulating. It is a fascinating look at cycles of outperformance between US and Non-US stocks. It seems to suggest we are at a start of a cycle where European, Australasian, and Far East (EAFE) stocks will outperform American ones. We hope so! Nearly 70% of our portfolio is in businesses operating outside the US.

Links of the Week

This 100-Question checklist for vetting investments is excellent.

Granted, we are biased here, but this author sets up an interesting thesis for why this might be Brazil’s year.

According to this tweet, despite seemingly falling behind in the AI race, it seems that Google search actually gained share in 2023 (but it seems like Bing did too).

I’m sure you’ve all seen this by now, but its too good not to share. You know who might be the best musician + investor combo ever? Taylor Swift.

This one is just for the hardcore, but I recently re-read Michael Mauboussin’s “The Base Rate Book” paper and it was a strong reminder of how rare it is for companies to maintain high revenue growth rates.

Great update Pratyush, always enjoy reading your letters.

Thanks for the note, Pratyush. I loved it. Just curious to know if your fund has exposure to Indian markets as well. India is doing quite well. On CAGR vs IRR vs XIRR very well written. I am struggling to get this nailed down for my 4 year portfolio as there is not a good automated reliable software to get this done for individuals. Thanks again for sharing.