Know Thyself

This week we discuss how to prepare for market cycles, talk Tesla valuation, and read a deep-dive into OnlyFans economics

Dear Clients and Friends of Farrer Wealth Advisors, we are pleased to bring you the Farrer Wealth newsletter, which includes our latest blog posts, data, and general articles we find interesting. Happy reading and happy investing!

Disclaimer - This newsletter is for informational purposes only. None of the below should be considered investment advice nor solicitation for investment. Please see full disclosures at the end of this newsletter.

Latest Blog Post

Know Thyself…

Peter Lynch used to describe where we are in the market cycle using the analogy of a cocktail party. The bottom is when an equity fund manager walks into a party, and is avoided by most. The next stage is where acquaintances strike up a conversation but talk about how the market is risky. The third stage is when guests ask for stock advice, and fourth and final stage is when guests give the equity manager stock tips.

Over the past few months, I’ve been getting the typical stage three question of “What should I be investing in?” My follow up to that is always a series of probing questions: What is your ability to take drawdowns? How much are you willing to lose? What is your time horizon? Most market participants don’t know how to answer these questions, because of two fundamental issues – they don’t know themselves and they don’t understand their goals.

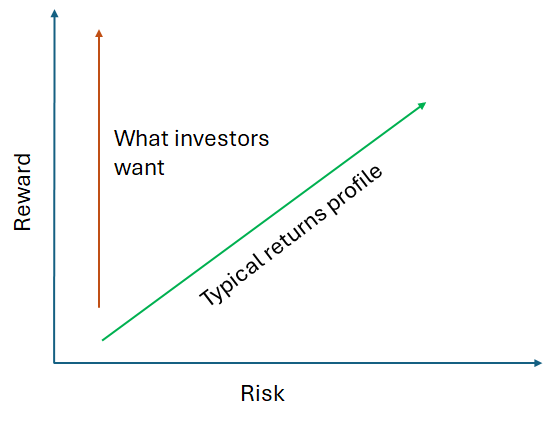

The most straightforward reason for this lack of understanding is because at the core of it, most investors want the most reward for as little risk as possible. Note that this is different from the most reward for the amount of risk taken. The nuance here is important, because there is nothing wrong with wanting to take less risk and thus earn less reward, or wanting to take more risk to try and earn additional percentage points in return. The issue comes in the muddling of the trade-offs. Discovering where you are on the spectrum is derived from self-awareness.

Knowing yourself: Like in life, in investing, it’s imperative to know yourself. How patient are you? How are you going to react when the market or your stocks sell off 50%? How are you going to react when the market or your stocks rise 50%? I remember listening to famed podcaster Tim Ferriss, who said that he doesn’t invest in public markets because he can’t take the volatility. Instead of laughing at his timidness, I was instead impressed by his self-awareness. He went on to say that he chooses to invest in private markets because he feels like he has an edge due to his network – another insight grounded in thoughtful consideration of strengths and weaknesses. Just the opposite, I do almost nothing in the private markets. I have no edge, lack a network for deal flow, and have realized that I cannot handle the binary outcome of most venture deals (learned the hard way).

One of the benefits of ‘knowing’ yourself is that you understand quickly what to say ‘no’ to. Buffet has spent his entire investing career saying no to growth stocks. George Soros, a famed trader, lived up to his profession by rarely holding long-term positions. Saying “no” is a powerful tool to an investor, but it is only useful when you know what to say “no” to.

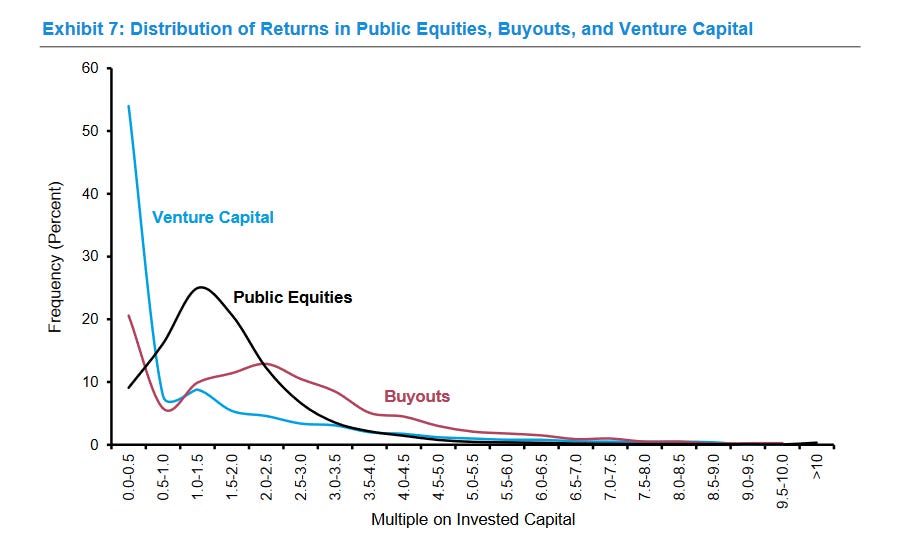

Understanding your goals: I was at a conference recently and was listening to a panel featuring family office principals. Without fail, each one said their main goal was wealth preservation, and then went on to say they had been spending much of their time in venture investing. One even went so far to say, without any irony, that he liked venture investing because the dispersion of returns was higher. This is true, and that’s why typically, venture investing does not align well with wealth preservation. In this paper by Morgan Stanley you can see that the chances of losing money are much higher in venture than in public markets or buyouts, but for some bizarre reason, people feel that venture investing fits nicely into the wealth preservation goal.

The reality is most venture investments are zeroes. Most venture funds will not return your money over their 10-12 year period. Despite its popularity, venture investing is a highly risky proposition. To be clear, I am not saying do not do it, what I’m saying is that it must align with your goals.

Some have less ‘risky’ goals. Morgan Housel is one of the most prominent financial writers of our time, and despite his insights, financial knowledge, and access to company management, all he does with his money is index. He understands the odds of success that come with just indexing are significant. Many read his book (The Psychology of Money) and other books by popular indexers like John Bogle, and decide all they want to do with their money is index. This is a reasonable and highly advised goal, but what most don’t understand is the time frame needed to make this strategy work. If you just indexed from 2000-2009 into the S&P 500 you would have lost money after 10 years. Held for an additional 10 years though and you would be laughing your way to the bank. But what kind of human does something for 10 years without success and decides to do another 10 years? A rare one. I’m confident that Housel is such a human. His followers? I’m not so sure. Part of understanding your goals is understanding your time frame. Indexing works, but over decades.

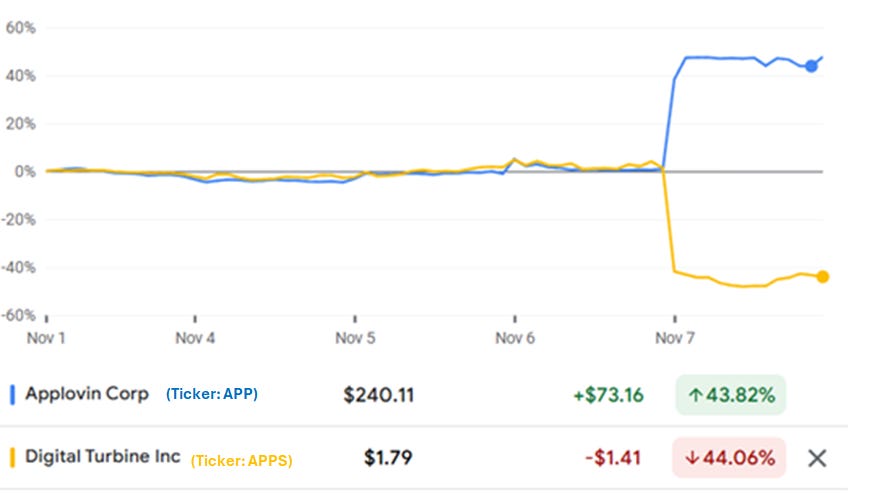

As the market moves from stage three to stage four, as it inevitably does, it’s important for investors (retail and professional) to remember who they are and what their goals are. I don’t think we are in stage four just yet, but it is coming. We are seeing humongous pops in stocks after solid earnings, which is indicative of stage four, but we are also seeing decimation on poor earnings, which is less indicative of a euphoric stage.

Given the Republican dominance across the executive branch of the US government recently, I suspect the next four years could be quite strong for markets. Bills/policies, which tend to be more business friendly under Republicans, will get passed quickly, and many of the FTC and DoJ cases against big tech will likely disappear.

Assuming this, we are likely to enter a stage 4 setting sometime within the next four years. Probably sooner rather than later. Stocks will rip on little news, loss-making but high growth companies will moon, and your neighbour will make money hand over fist. Stage 4 rallies are hard to resist. Everyone thinks they can get out before the music stops, but few can. Even great traders like Stanley Druckenmiller have been taken in (he lost $3 billion buying at the top of the 2001 bubble). The only way to survive relatively unscathed is to know yourself and your goals. Is your goal wealth preservation? Then high volatility plays are not for you. Is your goal to make as much money as possible in as short of a time period as possible? Then go forth, my wayward son, but don’t gamble more than you can afford to lose. You know you fall prey to FOMO? Turn off news, check stocks once a month. If you know you’ve been taken in by past stage 4 rallies in the past (we all have) – then remember those lessons and apply them well.

Professional investors should also think hard during these stages. I’ve seen traditional value investors completely disregard discipline and pay for stocks on revenue multiples. I’ve seen growth investors nail the stage but then fail to retreat and see their positions fall 60-80%. I’ve seen long-term investors increase their portfolio churn from 20% to nearly 90% (i.e. hold stocks for on average five years to about one year). I laughed out loud today when I saw a tweet that said “stop looking at stocks you would never have considered a week ago” because that is exactly what I was doing.

Preparing for various stages of the market cycle is simple, understand yourself, your goals, and that will guide your actions. However even if it is simple, it does not mean its easy, so I wish you all the best in the next stage of the market.

Thanks for reading and happy investing.

Chart of the Week

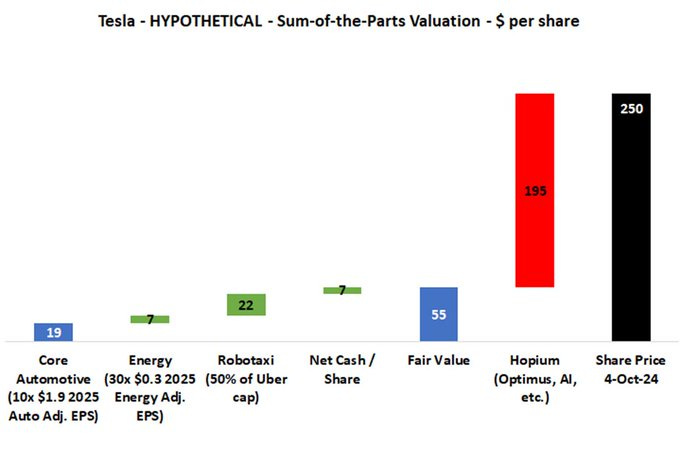

Future Value? This is a great visual breakdown of what is baked into Tesla’s share price. One can argue about the base assumptions, but its hard to argue that much of Tesla’s share price is based on products and visions that are yet to be monetized. The value of this “Hopium” as the chart author calls it (source) has only increased since this chart was made. Investors should trust they are right about Musk’s promises, otherwise they have overpaid for the stock.

Links of the Week

While we can debate the morality of OnlyFans, we cannot debate what a money machine it is. This article breaks down OnlyFans’ financials.

I am far from an expert on semiconductors, but I found this bear case on ASML intriguing to read.

Despite a strong market, IPOs are still waiting to make a comeback. This chart shows how few there have been compared to previous years.

For you payment nerds - this was a cool visualization of Europe’s largest merchant acquirers.

This is a long but worth it lecture about Strategic Reading, and how an ability to read and digest information will be an edge in an AI and summary driven world.

Interesting thread on the easiest ways to make money.

A kind request - if you enjoyed this newsletter, I would be most grateful if you could give it a ‘like’ or share it. Thank you!

Great stuff

Thank you for this blog. At the small end of the market it can feel like all four stages happen at various stages within a (market) cycle, or at least this has been the case since the Covid bottom and for some commodities there have already been a few cycles (Iron Ore). Hopefully most investors have worked out the questions you pose, otherwise a punch in the face could happen soon as for broader markdt we're definitely a long way from bottom, at least in terms of time. Your blog post is a good read for those investors, as is Howard Mark's book on market cycles.