Sea - Limited, it seems

This week we discuss Sea's recent earnings, its future, and the bull and bear cases

Dear Clients and Friends of Farrer Wealth Advisors, we are pleased to bring you the Farrer Wealth newsletter, which includes our latest blog posts, fun facts, and general articles we find interesting. Happy reading and happy investing!

Disclaimer - This newsletter is for informational purposes only. None of the below should be considered investment advice nor solicitation for investment. Please see full disclosures at the end of this newsletter.

Latest Blog Post

Disclosure: Farrer Wealth’s clients may have positions in the securities discussed below. The following writeup is for discussion purposes only and by no means is any sort of recommendation to buy, hold, or sell any of the stocks of the companies discussed below.

The below is based on my discussions with several bulls and bears on Sea over the past few days. Thus, the writeup is an amalgamation of their inputs and my thoughts. For those who took the time to speak to me over the past few days – many thanks – your words are reflected below.

This week, we saw the absolute brutal drawdown on Sea Limited’s stock after it posted a mixed result. Revenues came in light growing only 5% yoy but profits exceeded expectations, with the company posting a profit margin of positive 11% versus -32% a year ago. However, the reason the stock nosedived nearly 30% was because the company announced that it would start to prioritize revenue growth over profits, spooking the market that just got used to the significant ramping of its profits. More importantly, investors took it as a sign that this company cannot grow and make money at the same time. The implication of this is there is no moat around the business – namely its ecommerce arm Shopee (where most of the spend will go).

There are several aspects of the business to discuss here, and I’ll break up this writeup in some of the main parts to make it easier to digest. Namely I discuss E-commerce competition more generally, Tiktok (the new aggressive kid on the block), Shopee’s spending ambitions, Investor turnover, Other Segments, and Valuation.

E-commerce competition:

I’ve been thinking about the fact that Shopee needs to spend to regrow. My initial reaction was similar to what the market expressed – what kind of business is this if it can’t grow and be profitable? But the more I think about it, and the more I discuss with others, I think this is a premature statement. E-commerce in Southeast Asia is by no means mature. The three largest players are all relatively new. The oldest, Tokopedia (Indonesia) started in 2009 but didn’t really receive a large round of funding till 2013. Lazada (Alibaba) started in 2012, but didn’t properly launch till 2013, Shopee also only kicked off in 2016. So, on average, e-commerce in its current form is a little less than a decade old. E-commerce in China and the US on the other hand has existed since the late 1990s. E-commerce market share is over 30% in China, near the mid-20s in the US, but only about 15% in Indonesia (SEAs largest market). So given this relative immaturity, it is impulsive to think that any one company ‘owns’ the market or is ‘owed’ the market. It is still very much up for grabs and the ‘spending to grow’ strategy continues to be a necessity until maturity is reached (I will admit I’m unclear when that will be).

Further, almost every regional e-commerce market is competitive. China, for all its maturity, just saw JD in March this year launch a RMB 10 billion “subsidy program” to fight rival PDD, an action which crashed e-commerce stocks in the country. E-commerce in India was and continues to be a knife fight between giants Flipkart and Amazon and a whole host of niche players (in fact Amazon’s international e-commerce operations still loses money). Europe has no dominant player, and most local players shake when Amazon enters the fray. The US has not seen this level of competition because Amazon became dominant so fast in the early days of the internet that no competitor could really hope to mount a challenge. Jet.com gave it a go but was quickly acquired by Walmart for $3.3bn (which incidentally wound jet.com during covid). There are a few other examples such as MercadoLibre, but even there Shopee has shown a quick land and expand strategy does work.

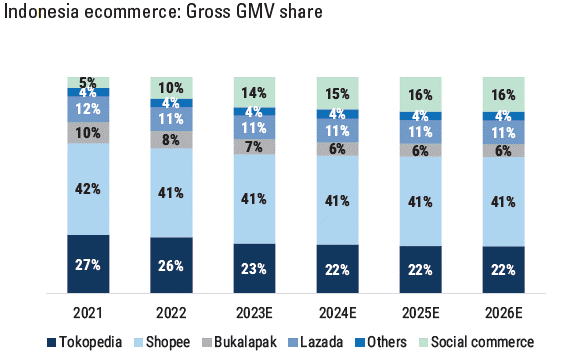

Given the above, I do feel that thinking that Shopee had dominated the market (it holds a ~40-45% market share) and could kind of coast from here was a fool’s dream (and one I am guilty of dreaming). As an aside, one could read the above and conclude that e-commerce is a terrible business, but that’s a topic for another day.

TikTok:

The new big bad wolf on the Southeast Asian scene is TikTok which has launched its highly successful Live Shopping strategy in several markets. TikTok has billions to burn and is eager to gain ecommerce dominance in several markets (including the US). Goldman reports show that they are likely to capture a 14% market share in Indonesia by the end of this year.

I saw some arguments on Twitter that said if Shopee had just invested more in their logistics network they would have been able to stave off TikTok. I think this is nonsense, Tokopedia has developed its own logistics since 2019 and it's still losing GMV. Having logistics systems in place is not really a barrier to entry (TikTok relies entirely on third parties). Also ask any Shopee user, the platform (offering and delivery) is significantly better than during covid.

While I think TikTok will do well in SEA, I have some doubts about how well they can do. For one, even in China live commerce is about 15-20% of the market. So, given that base rate – how can we expect TikTok to gain more market share than that in SEA? According to Goldman, most of that gain will come from taking share from Tokopedia (which has already shown it is losing GMV) and Bukalapak which has been up for sale for years. There is an argument here that TikTok will launch a more traditional ecommerce platform (likely in the next month) but consumers use different apps for different things. TikTok has a dual purpose (entertainment and shopping) whereas their shopping app will just be for, well, shopping. So it may not appeal in a market where most users already have several shopping apps on their phone. There are good faith counterarguments here (i.e., subsidies), so I will present a few more points. Next, I have seen data showing that while TikTok is doing well in the region, its growth is no longer a diagonal line up. In Indonesia, we saw a peak in March, and weekly sales have struggled to cross that high water mark since. There are also varying degrees of success across the Philippines, Malaysia, Thailand, and Vietnam. Third, Indonesia has recently banned cross-border shopping. Regulators in the country have prohibited the selling of imported goods under $100 on ecommerce sites. This is highly beneficial to Shopee which in Indonesia only has low single digit percent of GMV from foreign sellers. My understanding is that TikTok relies mostly on cross-border transactions.

This brings me to the final point – is Indonesia worth it for TikTok in the long-run? The real honey pot for the company is not SEA where the average income per capita is less than $5000 (not including Singapore and Brunei) but in the United States. I’ve heard from other investors that TikTok is doing incredibly well in the most lucrative market in the world (although I’m yet to see concrete data on this). There is also an argument that competition in the US is complacent, and that’s why the likes of Shein and Temu have done so well in the country (Temu as of a few months ago already has over 100MM users in the country). So, there could be a scenario where Shopee ups its game and fights tooth and nail with TikTok (which we know they can do) will they, TikTok, continue to push? It reminds me of the time I worked at Grab and the company was in a brutal battle against Uber. Uber had better technology, more money, and more experience in ride-hailing, but Grab knew it had to win. Unlike Uber, Grab was fighting on home turf, it had nowhere to go, whereas Uber could retreat to several of its core markets. In the end Grab won, it had no choice but to.

This brings me to the last point. Shopee (and Sea’s management) was lambasted for being overly aggressive during 2020-2021 and launching in several markets in LATAM, India, and Europe. The overreach did bite them in the behind and they had to retreat. But for whatever reason, the market seems to think that TikTok employing almost the exact same strategy will be successful. If we’re being intellectually honest, we must admit that TikTok will also likely mess up along the way and retreat from markets where the battle is tougher (or less lucrative).

Spend to Grow:

Ok, all the above said, I do not mean to imply that Shopee is guaranteed victory. They are likely going to have to hit the afterburners over the next few quarters, and as investors we can hope that they don’t start to lose money again. The company has proven that it can be profitable when it wants to be, has a boatload of cash, and now, is likely to burn profits. The best case scenario is that they run Shopee to breakeven, the worst is that they run the whole company to breakeven (i.e. take all profits from DFS and Garena and spend on Shopee). I have seen data (Yipit) that July GMV growth for Shopee was already 8%, mostly driven by Vietnam (+47%) and Brazil (+30%). Indonesia is up 6% but that’s up from just 3% in June. So, it looks like the company has already started to spend.

My hope as an investor is that they spend mostly on building logistics to boost 24-hour shipping and even launch same-day shipping. But the company has already stated that they are going to start to subsidize shipping, etc. I hope it doesn’t get back to the 2020 days where discount coupons were all the rage. There will be some of that, they do need to win back low-value customers from TikTok but a complete 180 to that would be, in my opinion, detrimental to investor confidence.

Despite all this, I do run into a wall that is probably the best bear case. Let’s say Shopee spends aggressively, besides market share steals, where will incremental growth come from? Indonesia was hit hard by covid, and even now, its GDP growth is ~5%. Considering private consumption makes up for 59% of the country’s GDP, you cannot assume that that segment will grow so much faster than overall GDP. Indonesia, and much of SEA, for all its potential, is still quite poor. The bull’s take on this is three-fold: 1) A continued shift from offline to online spend 2) launch of more services (travel/ticketing) 3) Better GDP growth in 2024 onward. I’ll be honest, this is more hope than fact. That said, it does seem like management sees something I don’t (as they would as they are closer to the ground) and did state in the latest earnings call that (“Meanwhile, the economics of our region have remained resilient, with inflation largely under control. This further boosts confidence in the long-term growth prospects of our markets”). So, we shall sea (pun intended).

Investor Turnover:

I wanted to think that the 40% drop in the stock price was driven by opportunistic short sellers. But according to the sell side, it was funds positioned long, dumping the stock. I think this has been one of the more frustrating parts of being a long-term shareholder is that the cap table changes so quickly. Initially, Sea’s shareholders were more traditional growth investors, and when the stock started to do well, retail investors bought in. These investors got burned hard in 2022 and bailed out to be replaced by investors of a more value bent who invested in the stock after Sea posted a surprise profit during the Q42022 earnings. But upon hearing that the company was going to go back to burn mode this quarter, these new investors sold out. So, for a while I think, Sea will be a bit of lost stock looking for a new longer-term investor base who believe in the story.

I can imagine how frustrated management might be. First, they heard: grow fast. So, they grew. Then they heard: become profitable, so they became profitable. And now, they heard: you need to grow again – so they are doing just that. Now don’t get me wrong, I’m not a management apologist, I have been quite vocal about how silly they have been in the past (and more on this below) but I do think they were in a bit of a damned if you do damned if you don’t position. Also, the rise of competition gave them very little choice. But I will say this about management, they are like the Juggernaut, and it is their blessing and their curse. When going in one direction, they will go full speed ahead and are not able to U-turn until it’s a bit late.

Other segments - DFS/Garena

We can’t wrap this blog up without quickly discussing digital financial services and Garena. For Shopee to grow we need these two businesses to grow/maintain the status quo. On DFS, revenue growth was impressive (+53% yoy), along with a very healthy 28% operating income margin. My problem here is that they also posted $600MM in credit losses over the past 4 quarters, and over a loan-book of $2,000MM that’s a 30% loss ratio! Now, that must imply that most of the ‘book’ is off-balance sheet. I’ve heard the size of the off-balance sheet book is anything from $3,000MM to $6,000MM. If it's $6,000MM then the overall loss is about 7.5% ($600/$8000). Still high, but palatable, considering they charge around 30%+ to borrowers and have a cost of funds around 4.5%. Also, I’m unclear as to the terms, because typically if the loan is off-balance sheet, then Sea should not take the loss or it, but it could be that their agreement with their partner banks is that they take the first tranche of losses. All this is my long-winded way of saying that while it appears that DFS is doing well, we really don’t know what’s under the hood. It’s also annoying that they don’t give Net Interest Margins and NPA ratios – what kind of lender doesn’t disclose such metrics? Anyway, I have heard that Seabank in Indonesia is signing up more and more partners, so something seems to be going right.

On Garena, I wouldn’t read too much into their growth in Quarterly Active Users, it's likely that this was just a summer bump. While there might be some upside here if Undawn does well or if Free Fire is re-launched in India, its likely Garena will be at zero or low growth for the foreseeable future.

Valuation:

Ok, this is going to be quick and dirty. Good-faith investors can argue whichever way they like, but I just wanted to get a sense of what is priced in.

This back-of-the envelope calculation shows us that at current market valuation Shopee is valued at $6.41bn. This is a company that (annualizing the last 3 quarters) does about $8.3bn in revenue (so trading at 0.75x revenue) and $738MM in EBITDA (so trading at 8.7x EBITDA). Now I’m not going to comment on whether this is expensive or cheap, as to know that you must take a call of what future profitability is likely to be like, and I mean really in the future, as the next two years is likely to be zero profitability.

Another way to look at this is that Shopee has spent $8bn since 2016 (calculated via EBITDA loss) to get to a 40%+ market share in SEA (some of that also includes Brazil spend though). So, let’s assume to get to say a 20% market-share, TikTok has/will, spend at least $4bn (especially since there are entrenched competitors). So, if $4bn gets you 20% market share (which is completely unprofitable), what should 40%+ profitable market share be worth at the minimum?

Again, I don’t want to draw conclusions here, but it’s important to think about what is priced into the current market price. Also, for those who argue that DFS should be valued much higher – my response is I will only give it a higher valuation when the company discloses more.

Conclusions:

As a pure investment case study, I think Sea offers a lot to dig into. There is plenty for the bulls and the bears, and I hope I’ve laid out a bit of both cases. But if you are a bull, I do think for the stock to work we need to see a few things over the next year.

- Shopee GMV growth reaches double digits (ideally 15%+)

- Shopee profitability is still existant even if it is thin.

- TikTok foray is limited to about 15-20% market share in SEA

- DFS continues to grow at a rapid pace and credit costs ratios do not increase.

- Garena doesn’t get any worse

If you are a bear, you need to see nothing, you already won.

All the best to long-term investors. Being a Sea shareholder can be the highest of highs and the lowest of lows (emotionally and stock price wise!).

Thanks for reading and happy investing.

A kind request - if you enjoyed this newsletter, I would be most grateful if you could give it a ‘like’. Thank you!

I think there's still too much uncertainty for SE to be a "screaming buy" even here after the plunge. Management is clearly intent on spending more money to gain market share in the next 3-4 quarters at least. There's no visibility to margins or upward inflection. Strong competitors all around. Will BABA's Lazada increase competitive pressure in SE Asia once it spins off from the parent co? Will PDD's Temu enter SE Asia at some point?